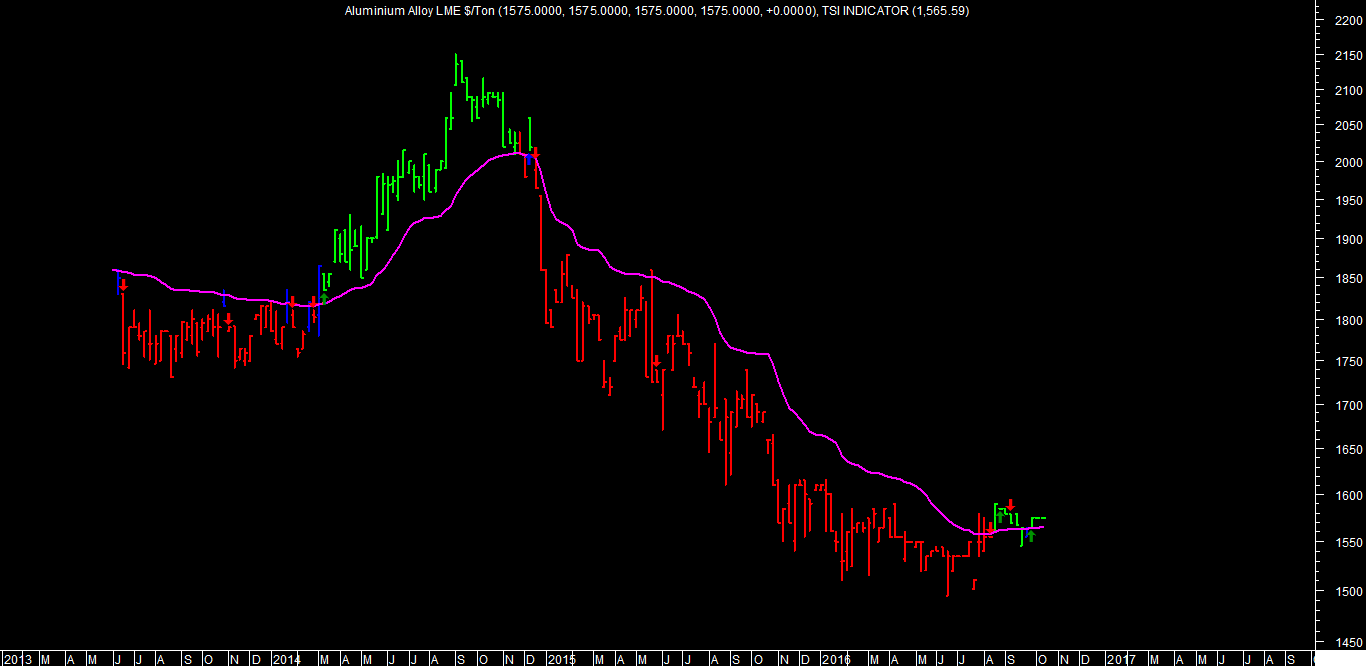

Report For Date 17/10/2016

Aluminum Alloy LME- (Price figures in $/Ton)

Accumulate at 1575-1558 as the opportunity arises.

Expect higher range of 1578-1588 to be tested.

Weekly Levels For LME Aluminum Alloy

|

STRATEGY

|

CLOSE

|

DRV

|

TREND

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

Accumulate

|

1575.00

|

1565.59

|

UP

|

1590

|

19.08

|

1558

|

1568

|

1572

|

1578

|

1588

|

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.