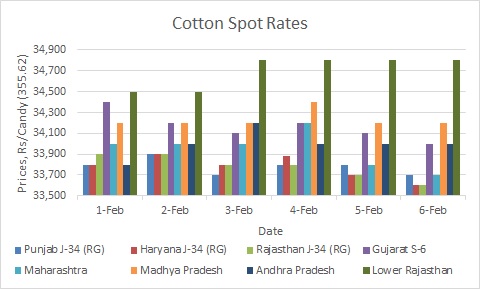

MUMBAI (Commoditiescontrol) - An increased level of volatility was observed in domestic cotton markets throughout the week ending 6th February, 2016.

The commodity opened the current week on a firm note across all the centres, continuing the tone from last weekend.

By the middle of the week, prices were seen trading on a steady note, but then a sideways tone dominated the market during the rest of the week, capping upward movement.

Difference between week’s high and low was the range of Rs 200-400/candy throughout the country.

CALM MOVEMENT IN YARN MARKET DUE TO CHINESE LUNAR NEW YEAR

Movement in domestic yarn market has been negligible from the last many sessions due to subdued demand at the current rates.

During the week, yarn prices declined Rs 1-2/kg, with market people foreseeing a substantial correction in various types of yarn in the next few days.

Yarn market experienced nearly muted activity following the approach of Chinese Lunar New Year. A week-long Chinese New Year holiday, starting Monday (8th February), had made overall business lethargic.

On Friday, 20 cotton combed yarn quoted at Rs 175-177/kg in Ludhiana (Punjab), 80s combed warp prices traded steady at Rs 1,460-1,480/5kg in Mumbai, while 30 combed yarn was priced at steady at Rs 175-180/1kg in Ichalkaranji.

India exported nearly 32.3 million kg cotton yarn in the first week of January. However in the second week of Jan 2016, exports fell to 20.6 million kg.

Share of China continues to come down to around 34 percent of total exports in the latest week of January, this is down from the share of 50 percent average weekly exports to China in 2015.

Cotton yarn exports to Pakistan has increased sharply from being less than 2 percent of total exports till November 2015 has now increased to 5.5 percent on average since first week of November 2015.

PROLONGED DOWNTREND IN CRUDE OIL PRICES

With crude oil prices falling incessantly, there are concerns of fall in cotton yarn demand as lower crude oil prices make synthetic fibres like polyester competitive against cotton yarn.

Crude oil prices have been subjected to increased volatility in the recent times. Prices ended the week lower in choppy trading on Friday, snapping two weeks of gains, as a frenzy of speculation about a possible deal between top oil producers clashed with concerns about a growing supply glut.

Global benchmark Brent crude futures settled down 40 cents, or 1.2 percent at $34.06 a barrel, after trading between $35.14 and $33.81. They last traded down 44 cents at $34.02.

In the wake of slumping crude prices, domestic textile mills, particularly big mills, are showing less interest in building inventory and doing business in a cautious manner.

CHINA’S RESERVE COTTON AUCTION POSES THREAT

There are reports in markets that China may instead sell its reserve cotton at lower rates. It is said that the auction will be implemented after March, 2016. It is important here to mention that most of the reserve cotton is ageing or are of inferior quality. Talks are that the floor prices of cotton auction is set to be followed by Cotlook A Index.

Further, there are strong rumors in market that China would also sell its cotton in international markets. If that happens, there will be ample availability of low grade cotton in world markets, So traders who wish to buy inferior quality cotton, will try to buy as much as possible from China.

COTLOOK INDEX AT 5-MONTH LOW

Cotlook A Index breached lower level of 67.25 on Friday settlement, which was last seen on 30th September, 2015. The index is likely to test a bottom of 67 this season, as indicated by technical chart.

CAB CROP ESTIMATE MISSES MARKET EXPECTATION

The latest crop estimate by Cotton Advisory Board (CAB) released could not lift market sentiment as expected.

CAB has further slashed India’s production estimate to 352 (170kgs each) lakh bales against its previous estimate of 365 lakh bales.

However, participants had expected the body to lower output as low as 320 lakh bales for 2015-16. According to the Cotton Association of India (CAI), India’s output is estimated at 357 lakh bales.

A difference of 5 lakh bales between the two agencies is normal, which has been the trend from the last many years.

DOMESTIC ARRIVALS YET TO PRESSURE MARKET

Although, daily cotton arrivals are yet to pressure underlying sentiment of participants as supplies are relatively lower this year so far compared to previous years.

Reports of lower crop production in the country as well as in the major international growers is holding farmers and stockists back in releasing their stocks at the current rates on hopes of better profit later.

Media reports suggest that country’s farmers have sold only 40 percent of their stocks in the ongoing season so far and are still holding on to 60 percent of their produce.

Mr. Arun Dalal, a veteran trader from Ahmedabad said that robust export demand during November-December 2015 had raised farmers’ expectations with regards to getting better returns.

In January 2016, all India cotton arrivals were at around 17 lakh bales (170kg each), down 19 percent from around 21 lakh bales in the corresponding period last year, as per traders.

As per trade sources, farmers are not willing to sell kapas at less than Rs 1,000/20kg. Whereas, prices are hovering in the range of Rs 880-965/20kg since the last two months.

STRONG U.S. DOLLAR RAISES EXPORT PROSPECT

Gains in the U.S dollar augured well for market sentiment, raising hopes of improvement in exports in the current season. A strong dollar makes exports more lucrative, increasing chances of active buying by exporters for immediate shipments.

Indian Rupee closed the week at 67.53 per U.S Dollar on Friday, with a week high of 67.96 and low of 67.53.

Overall tone in the domestic currency is bearish. In the near-term, the currency may touch a low of 68.25, as indicated by technical chart.

Meanwhile, India’s cotton exports in January, 2016 of the current season, which started 1st October, 2015, recorded at around 40.07 lakh bales, as per USDA attache report. While imports were at around 2.30 lakh bales.

The other day Textile Commissioner Kavita Gupta at CAB meeting said that India may see cotton exports of around 70 lakh bales this season compared to 57.7 lakh bales in 2014-15.

She further said that Pakistan is likely to overtake Bangladesh as the top importer of Indian cotton in the season. Demand in Pakistan has grown due to crop damage in Punjab region. Almost 33 percent of cotton crop in Pakistan has been damaged from whitefly. Pakistan has already imported 16.60 lakh bales cotton from India till 31st Dec, 2015 compared to 3.79 lakh bales in entire 2014-15.

FACTORS TO IMPACT PRICES IN THE LONG-RUN:

FOR PRICE RISE -

1. Lower Domestic & Global Crop Estimates In 2015-16

2. Limited Cotton Stock Position With Domestic Mills

3. Drastic Fall In Domestic Cotton Supply

4. Exporters Buying To Fulfill Previous Commitments

5. Gujarat Government’s Bonus Scheme; Other States Also Seek Implementation

6. Government Policy (TUF Scheme, Various Steady Government Promote Textile Sectors Benefits, Technical Textile, Hopes Of Some Benefit In Next Budget)

7. Overall Weakness In Indian Rupee

8. Shortage Of Good Quality Cotton (Domestic & International Markets)

9. Poor Crop Condition - Pink Boll-worm And Reduced Yield Due To Inadequate Rain

AGAINST PRICE RISE -

1. High Unsold Stock With CCI As Well As Big Merchants

2. Reduced Chinese Demand. Adding That Up, It Is Considering Auctioning State Reserve Cotton Also china Closed on New Year Festival

3. Slow Consumption In Near-Term

4. Liquidity Pressure In Cotton Industry

5. Lower Crude Oil Prices (Competitive In PTA/Silk Yarn Market)

6. Vietnam Trans-Pacific Partnership (TPP) Policy

7. Depreciation In Currency Of Major Exporting Nations

8. Textile Mills In China Facing Financial Problems

9. Few Big Cotton Traders Settle Forward Business In Cash & Selling There Stock In Domestic Market

10. Indian Cotton Unviable For Export

11. African Countries’ Duty Free Exports (Some Indian Mills Already Made Contract For Feb-March Delivery)

12. Movement Improved In Cotton Market Compared To That Of Cotton Yarn

13. Global Liquidity Crunch

14. Slower Demand In Cotton Yarn

15. Slower Demand In Cotton And Gray Market

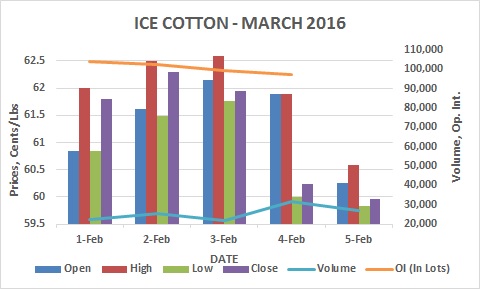

U.S MARKET THROUGH THE WEEK

U.S cotton market exhibited a see-saw trend during the week mainly influenced by gloomy macro fundamentals and concerns over China reserve auction. Market sentiment was expected to receive a strong push in the wake of robust encouraging US export sales data, another downward revision of the Indian crop and a weakening dollar.

The most-active March cotton contract on Intercontinental Exchange (ICE) settled the week down 0.26 cent, or 0.43 percent, at 59.97 cents per lb.

Opened the week at 60.85, with a high of 62.59 and a low of 59.83 cents per lb.

A strong weekly export data released by the U.S. Department of Agriculture (USDA) failed to trigger buying as players preferred to stay away from market awaiting China’s auction announcement.

Weekly U.S. government export sales data showed a rise of 96 percent from the prior week totaling 251,600 RB for 2015-2016 and 75 percent up from the prior 4-week average.

Increases were reported for Turkey (91,700 RB), Vietnam (74,800 RB, including 3,100 RB switched from Hong Kong and 800 RB switched from Japan), Pakistan (18,300 RB), Indonesia (13,900 RB, including 600 RB switched from Japan), China (13,700 RB), and Bangladesh (11,600 RB).

Meanwhile, ICE lowered cotton margins by 15.4 percent to $1,100 per contract from $1,300. ICE says margin changes are effective with the opening of business on Monday, February 8, 2016.

SPECIAL REPORTS THROUGH THE WEEK

CAB Further Cuts India’s 2015-16 Cotton Crop Size To 352 Lakh Bales

The Cotton Advisory Board (CAB) in its latest release further slashed India’s 2015-16 cotton crop output estimate to 352 (170kgs each) lakh bales against its previous estimate of 365 lakh bales. Textile Commissioner, Kavita Gupta attributed the 3.6 percent drop in production estimate to the first back-to-back drought in the country, hitting productivity (Click Here For Full Report)

ICAC Sees 2015-16 World Cotton Output Down 36.7 Lakh Tons YoY

International Cotton Advisory Committee (ICAC) in its latest cotton crop estimate for 2015-16 season, lowered world production 36.7 lakh tons to 224.6 lakh tons compared to 261.3 lakh tons in 2014-15. The latest estimate is also down 4.3 percent from 228.9 lakh tons estimated in January (Click Here For Full Report)

World Cotton Ending Stocks To Drop 14% In 2016-17 - ICAC

Even as world cotton production is estimated to rise nearly 3 percent, world ending stocks are likely to drop 14 percent to 19.48 million tons in 2016-17, as per International Cotton Advisory Committee (ICAC) (Click Here For Full Report)

India Cotton Arrivals Fall Over 19% Till 31st Jan, 2016 - Trader

In the current cotton season (2015-16), domestic markets have been subjected to frequent fluctuations in both, near and long-term fundamentals. As a result of which, market participants are finding it difficult to hold a fix bet on the commodity (Click Here For Full Report)

India’s Cotton Exports To China Total 32,080 Tons In December

India’s cotton exports to China, the world’s top consumer of the soft commodity, recorded a decline of 59.03 percent to 32,080 tons in December 2015 from the corresponding period last year, as per China's latest customs data. The data showed a drop of 70.55 percent to 2,42,416 tons in cotton exports by India to China during the first 12 months of the current season (January-December) (Click Here For Full Report)

India 2015-16 Cotton Output Estimate Pushed Down To 356 Lakh Bales - USDA Attache

U.S. Department Of Agriculture (USDA) in its latest attache report lowered India’s cotton production forecast to 356 lakh bales (170kgs each). USDA’s FAS Mumbai said that yields are down in Punjab and Haryana due to white fly attacks and pink bollworm in Gujarat (Click Here For Full Report)

Brazil Cotton Index Rises 17% In January

Cotton prices in Brazil remained firm in January as demand was seen increasing from domestic as well as exporters. In the month, the CEPEA/ESALQ Index raised 16.91 percent. With decreasing export parity and purchasers demanding cotton for prompt deliveries, producers kept firm in asking prices in the domestic market (Click Here For Full Report)

TOP STORIES THROUGH THE WEEK

Cotton Imports By China May Fall More 40% In 2016

Cotton Imports By China May Fall Another 40% In 2016 After Announcement Of Sale Of Reserve Cotton Sale. In Dec, Cotton Imports By China Were Seen At 188,000 Tons, Making The Year’s Total 1.47 Million Tons. That’s Down 40%, Or Almost 1 Million Tons, From 2014.

CHINA'S Textile Exports

China's textile exports total $99.7 billion during first 11 months of 2015, falling by 2.6 percentage points over the same period of 2014 - according to data from the General Administration Of Customs. November exports were $8.6 billion. In addition, clothing exports totaled $157.2 billion during the first 11 months of last year, representing a year on year decline of 7.7 percentage points. November exports were $13.3 billion.

China Yarn Imports May Stay Flat/Decline In 2016 - Traders

China’s yarn industry may be benefited from relocation to Xinjiang where raw material costs are subsidized. New set of equipment is expected to boost productivity at spinning mills. But cotton yarn market may continue to decline in China due to shift in yarn production to blends in the wake of cheaper polyester prices. Cotton yarn imports may stay flat or decline in 2016, barring lower counts up to 32s.

APTMA Seeks Notification For Reducing Industrial Electricity Tariff

All Pakistan Textile Mills Association (APTMA) sought immediate issuance of notification for reducing industrial electricity tariff. The expectation is in line with a landmark announcement of Rs 3 per kilowatt hour from January 1, 2016 by the Prime Minister. Prevailing industrial tariff for December FPA adjusted comes to about Rs 11.60 per Kwh. Announced reduction of Rs 3 per Kwh will bring it down to below Rs 9 per Kwh and get arched with electricity tariff of competitors in the region.

APTMA Demands 5% Rebate On Textile Exports

All Pakistan Textile Mills Association (APTMA) Has Demanded The Government To Wave Off Customs Duty On Cotton Imports While Provision Of Five Percent Rebate On Textile Products Export, Dunya News Reported Wednesday. The Association Has Put Forth The Demands In Light Of Low Cotton Production. Currently The Importers Are Paying Three Percent Customs Duty On Cotton. The Association Has Also Demanded A Five Percent Rebate On Export Of Textile Products.

China Mills Cotton Stock Holding

China mills average cotton stock holding increased as on February 4 – NCMMS. Average cotton stock including port arrivals held by sampled mills increased by 1.8 days to 33.3 days, 3.4 days increased than a year ago. The national cotton industry inventory of about 652,000 tons, an increase of 5.7%, an increase of 5.5%. major provinces. cotton industry stocks mixed, Shaanxi, Hebei cotton industry stocks is relatively large.

OUTLOOK FOR NEXT WEEK:

Cotton prices are likely to trade sideways in the next week as domestic textile mills are likely to stay away from purchasing at the current rates.

Downside is limited as sellers may not prefer to sell at the current lower level in order to avoid disparity.

According to an analyst at CC, overall fundamental now depends upon Chinese government’s decision with regards to reserve auction.

(By Commoditiescontrol Bureau; +91-22-40015522)