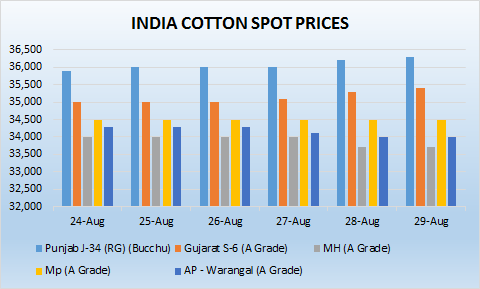

MUMBAI (Commoditiescontrol) - Movement in cotton prices in north Indian centres was positive throughout the week ending 29th August, 2015, gaining around Rs 30-40/maund (37.3kgs each) due to improved demand from local mills. On the other hand, prices ruled steady to firm in Gujarat, Madhya Pradesh, Maharashtra and Karnataka.

In Gujarat, normal trade was disrupted for most of the session due to Patel Patidar Community agitation demanding OBC status from the state government. Traders expect normal business to resume from Monday next week.

Central India has been receiving deficient rainfall from the last many days compared to other parts of the country. Poor monsoon rains in Maharashtra are likely to impact cotton in Marathwada Vidarbha region this year. Monsoon rains have given a miss to the area by being deficient during most of July and now in August also. If not revived lately, crop in the state will have to face sever damage.

Nearly 9 lakh powerlooms in Maharashtra’s Bhiwandi announced that they would go on strike demanding ban on import of clothes from China. The Bhiwandi Power loom Association have also decided to send one lakh postcards to Prime Minister Narendra Modi to draw his attention towards the crises in the sector. The powerlooms are protesting against hike in power tariff, obstruction in their work by yarn producers and are asking for permission to export their cloth.

On the other hand, cotton auctioned by the government procurement agency, Cotton Corporation of India (CCI) is dominating the south Indian markets. Here, movement in physical markets is muted as most of the daily commitments are being fulfilled by the CCI’s cotton. South-based private traders/stockists are left with negligible unsold stock.

Factors Which Might Aid Prices In Next One Month

1. Small Unsold Stock

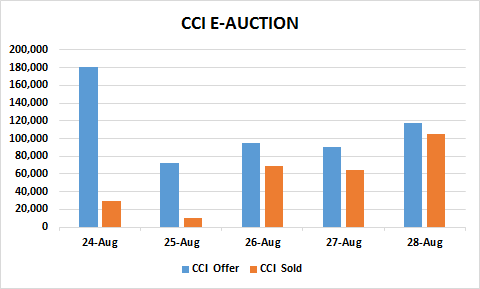

Currently, one of the major factors which is helping cotton prices stay firm is small/negligible cotton stocks with private traders across the country. Private traders or stockists in north India are left with an unsold stock of around 30,000-40,000 bales. Unsold stock with stockists/private traders throughout India is at around 5 lakh bales, while Cotton Corporation of India (CCI) is left with an unsold stock of around 32-33 lakh bales. Though, most of the urgent requirements are being met by the government agency’s cotton, especially south India mills, markets have to monitor the agency’s near-term sales. CCI has liquidated 2,79,580 bales this week out of 5,56,980 bales. All India arrivals as on date stands at around 359 lakh bales compared to 405.6 lakh bales in the corresponding period last year, according to traders.

2. CAI’s First Estimate For 2015-16 Crop

The Cotton Association of India (CAI) has placed its first estimate for 2015-16 cotton output at 380 lakh bales (170kgs each). The projected Balance Sheet drawn by the CAI estimated total cotton supply for the season 2015-16 at 470.65 lakh bales, while the domestic consumption is estimated at 325 lakh bales thus leaving an available surplus of 145.65 lakh bales. This is almost similar to the output of 382 lakh bales achieved in the 2014-15 season.

The association says the acreage under cotton during the ensuing 2015-16 cotton season is going to be less than that of the current crop year. Yield is, however, likely to be higher during the 2015-16 crop season due to good and timely rainfall in the cotton growing areas, Dhiren Seth, president, CAI said.

3. Lower Crop Estimates By Traders As Well

Though, a lot of seed companies are of the opinion that the country may not produce less than 380-385 lakh bales this year as yields are going to be higher, which will more or less compensate for lower acreage, few others believe that next year’s crop may be at around 370 lakh bales attributing ongoing issues cotton crop in facing in the south zone and Marathwada Vidarbha region of Maharashtra.

But then, there are few other analysts who said that it is not the right time to come to any particular conclusion as crop normally get circulated thrice or four times between farmers, government agencies, MNCs to traders and millers. Markets had initially estimated last year’s crop at 400 lakh bales, which was later revised multiple times by various agencies. But, now the output stood at around 358 lakh bales till last week.

Reiterating the same, Mr. Arun Dalal, a veteran trader from Ahmedabad said that it is early to estimate the total crop as sowing is still progressing at many places, weather remains unfavorable in many parts of the country, overall sowing acreage is down 8-10 percent in India and 3-4 percent the world over. The current currency war is also likely to affect business sentiment in the short-term, added Mr. Dalal.

4. Strengthening Dollar Against Rupee

Given the constant fall in the Indian Rupee, there are expectations of a possible spurt in exports demand in the short-term as Indian cotton is currently competitive in overseas markets. Rupee has been reeling under pressure since 11th August, the day China devalued Yuan. After this move by the world’s top economy, Rupee breached the level of 65 against the U.S dollar last week, which came as another positive signal for Indian cotton market. At the current level, there are expectations of a spurt in Indian cotton enquiry, especially from Bangladesh.

5. Limited Initial New Crop Arrivals

Another important factor hinting towards positive movement in cotton prices in the sessions to come is the estimated small arrivals of new crop in the initial days. Markets players expect the new crop arrivals in north India by second week of September. There are talks in markets that daily arrivals of new crop throughout the country will be at around 8,000-10,000 bales in the beginning. As a result, textile mills may remain bullish in the sessions to come as the new arrivals will not be enough to meet their daily requirement.

6. Competitive Yarn Prices

Yarn market has been witnessing positive movement from the last three-four days. Currently, 30 carded in Ahmedabad is trading at around 160-165/kg, Kolkata in the range of Rs 155-160/kg and Ichalkaranjis at around 150-160/kg. Indian cotton yarn prices remained firm due to improved demand in domestic markets. Also, polyester yarn prices remained stable in the past week after continuous decline.

7.Drifting Sowing Figures

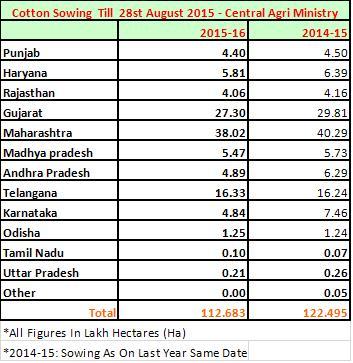

All India cotton sowing area reduced nearly 10 percent to 112.7 lakh hectares (ha) as on 28th August, 2015 compared to 122.5 lakh ha same period last year, according to a central government data.

Deficient rains over most of the major growing regions have led to overall reduced sowing figures under the crop. In fact, central India continued to receive least rainfall this week, remaining the driest part of the country. The central region recorded deficit of 72 percent, receiving actual rainfall of 16.7MM compared to 59.6MM of normal rainfall. Besides, another major contributor to the country’s total cotton output, south India, also remained deprived of sufficient monsoon rains, harming sowing activity.

Below is the state-wise cotton sowing data as on 28st August, 2015:

WEEKLY WEATHER ROUNDUP:

The country as a whole received below normal rainfall of 37 percent during 20-26 August. The central part of India received least rainfall of 16.7MM against normal rainfall of 59.6MM. Northwest India recorded rain deficit of 63 percent with actual rainfall of 16.3MM compared to normal rainfall of 44.5MM.

During the week, South Peninsula received rainfall of 35.4MM against normal rainfall of 39.6MM, with an overall deficit of 11 percent. However, rainfall over east and northeast India exceeded normal rainfall figure of 84mm, with actual rainfall of 108.3mm.

For the country as a whole, cumulative rainfall during monsoon season has so far up to 26th August been 12 percent below the Long Period Average (LPA). Rainfall activity was near normal in all the broad homogeneous regions of India except south Peninsula. Details of the rainfall distribution are given below:

Forecast For Next Week:

Normal to above normal rainfall activity is likely over east and northeast India during next 7 days and likely to become normal to below normal during 2nd and 3rd week of September. Below normal rainfall activity likely over many parts of northwest, westcentral and Central India during next two weeks Possibility of normal to slightly above normal rainfall activity likely over south Peninsula between 4 to 13 September.

.jpg)

Weekly Technical Update

MCX Cotton Bales Weekly (Price are in INR (Rs)/Bales)

Traders long can revise up the stop loss to 15600. Resistance is at 16477-16897. Further rise can continue above 16610. Buy if breakout and close above 16610 is witnessed with low of the week as the stop loss or 16270 whichever is lower.

(Click Here For Full Story)

NCDEX Kapas April’16 Weekly: (Price are in INR (Rs)/20 Kg)

Cover short position at 877 or below as the opportunity arises. Expect higher range of 885-904 to be tested. Weakness will continue below 855. Resistance will be at 885-904.

(Click Here For Full Story)

NCDEX COC September :( Price in Rs/Quintal)

Traders long can keep the stop loss at 1969. Expect higher range of 2072-2133 to be tested. Correction can be seen on fall and close below 1969. Broadly, till 1969 is not violated expect consolidation or sideways volatility. Breakout and close above 2078 can show further rally. Subsequently expect 2127-2133 to be tested.

(Click Here For Full Story)

SPECIAL COVERAGE THROUGH THE WEEK

Starch Demand Likely To Fall On Poor Textile Growth

Slow growth of textile industry may affect the demand for starch. Indian maize starch product has always been attracting good demand from overseas markets and has witnessed consistent growth year-on-year. But rise of an economic crisis in China has raised concern among starch manufacturers in India. Usually, starch prices are derived from maize rates. Also maize acreage, its yield, stocks followed by minimum support prices (MSP) decided by the government play major role in pricing of starch, said I. K. Sardana, President, All India Starch Manufacturer Association. Of course, starch exports may get affected if its prices are higher in domestic markets compared to overseas. Chinese alternative gives tough fight to the Indian starch industry in International markets and it is gradually occupying the markets of Indian product, he added (Click Here For Full Report).

Staple -Wise Support Prices Of Kapas - Central Govt

The central government has fixed support prices of medium staple length cotton and long staple length cotton of new crop (2015-16) of fair average quality (FAQ). The support price for medium staple length cotton has been fixed at Rs 3,800/100kg and long staple length cotton has been fixed at Rs 4,100/100kg. (Click Here For Full Report).

India’s July Cotton Exports To China Dip Nearly 90% On Year

India’s exports of cotton to the world’s leading consumer, China in July, 2015 saw a slump of 89.76 percent to 2,378 tons compared to the corresponding period last year, as per official customs data. During the first seven months of the current fiscal (January-July), it exported around 177,222 tons cotton to China, down 75.21 percent compared to last year (Click Here For Full Report).

CAI Pegs Cotton Production At 380 Lakh Bales During 2015-16

The Cotton Association of India (CAI) has released its first estimate of the cotton crop for the ensuing season 2015-16 beginning on 1st October 2015. The CAI has pegged domestic cottong production during the 2015-16 at 380 lakh bales of 170 kgs each. The projected Balance Sheet drawn by the CAI estimated total cotton supply for the season 2015-16 at 470.65 lakh bales while the domestic consumption is estimated at 325 lakh bales thus leaving an available surplus of 145.65 lakh bales (Click Here For Full Report)

US Cotton Crop Condition Seen 53% Good/Excellent - USDA

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ended 23rd August, 2015 stated that U.S. cotton crop condition stood 53 percent good/excellent compared to 55 percent last week and 51 percent a year ago period. According to the USDA report, 83 percent of the crop is setting bolls in all the 15 major cotton growing states during the week compared to 73 percent a week ago and below five year average of 92 percent (Click Here For Full Report).

Lower Production, Tight Supply Support Cotton Prices In Brazil

Cotton prices in Brazil continue to gain support from delayed harvesting, lower production and inactive selling. Further, gaining U.S. dollar, which increases export and import parity, prompting farmers to focus on contracts accomplishments, especially to international markets. The dollar increased 4.16 percent against Real until 24th August, 2015, Cotlook A Index raised 4.51 percent and the CEPEA/ESALQ Index, 4.54 percent (Click Here For Full Report)

Ivory Coast 2015-16 Cotton Output Seen At 450,000 Tons

Ivory Coast is expected to produce around 450,000 cotton tons in 2015-16 compared to 500,000 tons estimated earlier, as per Intercoton, the country’s cotton association. The country’s next year cotton output is lowered considering dry weather conditions, it said. Ivory Coast produced 450,000 tons cotton last season and output has risen steadily over the past five years. Ivory Coast is one of West Africa’s major cotton exporters (Click Here For Full Report)

ICE Dec On-Call Cotton Sales Rise 856 Contracts - CFTC

ICE cotton on-call sales in most-active December contract increased 856 contracts to 22,561 contracts. On-call purchases reduced 1,077 contracts to 12,237 contracts during the week ended 21 August, as per CFTC report. ICE cotton on-call sales in March contract also jumped 551 contracts to 16,903 contracts. On-call purchases increased 363 contracts to 1,108 contracts (Click Here For Full Report)

U.S. MARKET THROUGH THE WEEK

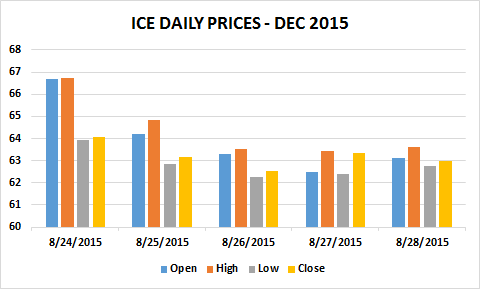

Cotton futures on Intercontinental Exchange (ICE) softened around 6 percent this week as speculators refrained from buying after suffering heavy losses during the sharp downtrend earlier in the week.

Cotton prices rose sharply during the first couple of weeks this month on a bullish U.S government crop forecast, but sluggish cues from China’s economic front followed by speculative selling turned cotton market bearish.

There is still concern lingering about China’s economic crunch, as China is the world's top consumer of the fiber. Traders said these expectations for weaker consumption may dampen the market sentiments.

U.S. export sales totaled 61,100 bales last week, with increases reported in Colombia, Mexico and Costa Rica, with shipments of 102,500 bales, according to a weekly U.S. government report. ICE cotton speculators raised net long position by 2,395 contracts to 44,382 in week to August 25.

TOP STORIES THROUGH THE WEEK

China Cut Interest Rates, RRR

China’s apex bank, the People’s Bank Of China, on Tuesday lowered its benchmark lending and deposit rates by 0.25 percentage point. The bank has also cut its reserve requirement ratio (RRR) by 0.5 percent point to be effective from 6th September, 2015. The move was aimed at the real economy, making sure that the growth slowdown is not too severe.

Benin Govt Offers $3.6 Million Loan To Cotton Farmers

Benin Govt Released $3.6 Million Loan To Country’s Cotton Farmers For 2015-16 Farming Season. With This, Farmers Would Get Support To Increase Their Produce. The Financial Aid Will Help Them Address The Challenge Of Shortage Of Inputs Which Has Been Affecting The Yield. The Govt Aims To Raise Country’s Cotton Output To Over 500,000 Tons In 2015-16 Vs 400,000 Tons In 2014-15.

Govt Closely Watching Current Market Crash - Jaitley

Finance Minister Arun Jaitley Said That The Govt Is Closely Watching Current Market Crash. The Minister Said That The Govt Believes That Markets Will Settle Down. Though, Indian Rupee Is Under Pressure Since Yuan Devaluation, RBI Said The Indian Currency Continues To Be A Favourite Among Investors And Is a Strong Currency.

Govt Imposes Anti-Dumping Duty On Caustic Soda Imports From China, S.Korea

The Govt Of India Has Imposed Definitive Anti-Dumping Duty On Caustic Soda Imports From China And South Korea. The Move Follows A Recommendation Of The Designated Authority In The Commerce Ministry, As Per An Official Statement. Caustic Soda Is Mainly Used In Manufacturing Of Pulp And Paper, Newsprint, Viscose Yarn, Staple Fibre, Aluminium, Cotton, Textiles, Toilet And Laundry Soaps, Detergents, Dyestuffs, Drugs And Pharmaceuticals, Petroleum Refining Etc.

Pakistan To Import Over 1.1 Mln Bales Cotton In 2015-16

Pakistan’s Textile And Spinning Sector Will Have To Import Over 1.1 Million Bales Of Various Qualities Of Cotton In 2015-16 To Meet Its Domestic Consumption Requirement. The Country’s Raw Cotton Demand Has Gone Up To Around 15 Million Bales (175kgs Each). The Karachi Cotton Association (KCA) Said That Around One Million Bales Of Cotton Have Been Damaged In The Recent Floods, Including Standing Crop In Punjab And Sindh. The Country Will Certainly Miss Cotton Production Target Of Over 15 Million Bales In 2015-16.

Textile Importers Defer Orders Till Rupee Stabilises

In The Aftermath Of Constant Fall In Indian Rupee, Overseas Importers Of Textile And Apparel Have Deferred Their Orders Till The Time Indian Currency Stablises. The Importers Intend To Re-Negotiate Their Contract Terms To Get Higher Realisation By Indian Exporters. Since August 11, The Day China's Yuan First Depreciated, The Rupee Has Fallen By Over 3.37% To Trade At 65.50 Against The Dollar Early Monday.

Pakistan’s Cotton Imports From India, U.S. Rise 8% In 2015-16

Pakistan’s Cotton Imports In 2015-16 May Rise 8 Percent From India, U.S. And Other Major Cotton-Producing countries. Nearly One Million Bales Of Standing Crops Of Cotton Has Been Destroyed In Punjab And Sindh Due To The Recent Floods. Textile And Spinning Sector Will Have To Import More Than 1.1 Million Bales Cotton In The Next Eight Months Of FY2015-16.

Textile Mills In Maharashtra Set To Go On One Day Strike On 1st Sep

Textile Mills In Maharashtra Will Hold A One Day Strike On 1st September, 2015 In Order To Divert Govt’s Attention To Continuous Slow Business And No Orders In The Last One Month. The Decision Was Taken On Wednesday At A Meeting Of Managements Of 55 Cooperative Mills In The State. Mills Owners Are Demanding A Reduction In Power Tariff, Subsidy For Exports And Soft Loans For Short Term So That They Can Pay Wages To Workers.

Badal Orders Girdawari For Damaged Cotton Crop

Punjab Chief Minister Parkash Singh Badal Has Ordered Conducting Special Girdawari For Assessment of Damage Caused To The Cotton Crop Due To Attack From The Whitefly, Other Insects And Pests Across The State. Badal Directed The Financial Commissioner Revenue To Issue Detailed Instructions Immediately To All The Deputy Commissioners In The State To Get The Entire Loss Caused To The Cotton Crop Assessed Especially In The Cotton Growing Belt Of Sri Muktsar Sahib, Mansa, Bathinda, Fazilka and Faridkot districts, where extensive damage has been reported due to curse of whitefly.

Finance Ministry To Start 2016-17 Budget Consultations From 4 Sept

Finance Ministry will start consultations on 2016-17 Budget with different ministries, beginning with commerce, textile and external affairs, from 4th September, 2015. The Finance Ministry has already started the budgetary exercise in mid-August, two months ahead of schedule. Consultations with different departments to be concluded on 28th September, would focus on expenditure proposals for 2016-17 and revised estimates for 2015-16.

Congress Demands Compensation For Punjab Cotton Growers

Congress has demanded the Punjab government for immediate release of compensation for cotton growers who were left with no option but to uproot the cotton plants damaged due to the whitefly attack. Congress workers visited the fields of the cotton growers and listened to problems being faced by the farmers who lost their entire cotton crops to whitefly attack.

OUTLOOK FOR NEXT WEEK

We at Commoditiescontrol, forecast cotton prices to move positive during the next week’s sessions. Downside in prices is limited as gradual regular demand from domestic textile mills and spinners would prevail in the midst of above mentioned supportive factors. Also, tight selling will prompt buyers source regularly. We also foresee some significant movement in yarn markets on expected surge in domestic mills demand.

(By Commoditiescontrol Bureau; +91-22-40015532)